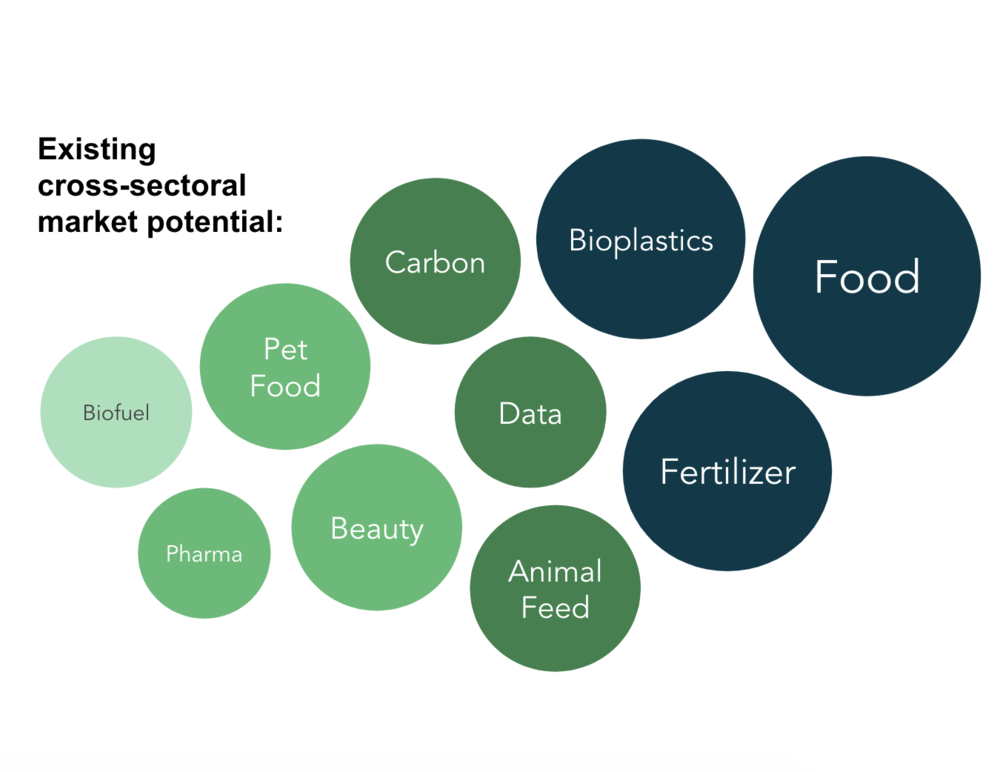

Market Opportunities

Market Landscape

The looming question for new regenerative ocean farmers is: Who’s going to buy all my seaweed?

Seaweed harvesting once was a major industry in the United States. In the early 1900s, 1,500 workers produced 52 different products from kelp on the docks of San Diego. The industry died after WWII (due to over harvesting), but it’s proof that seaweed was once a tangible part of the U.S. coastal economy.

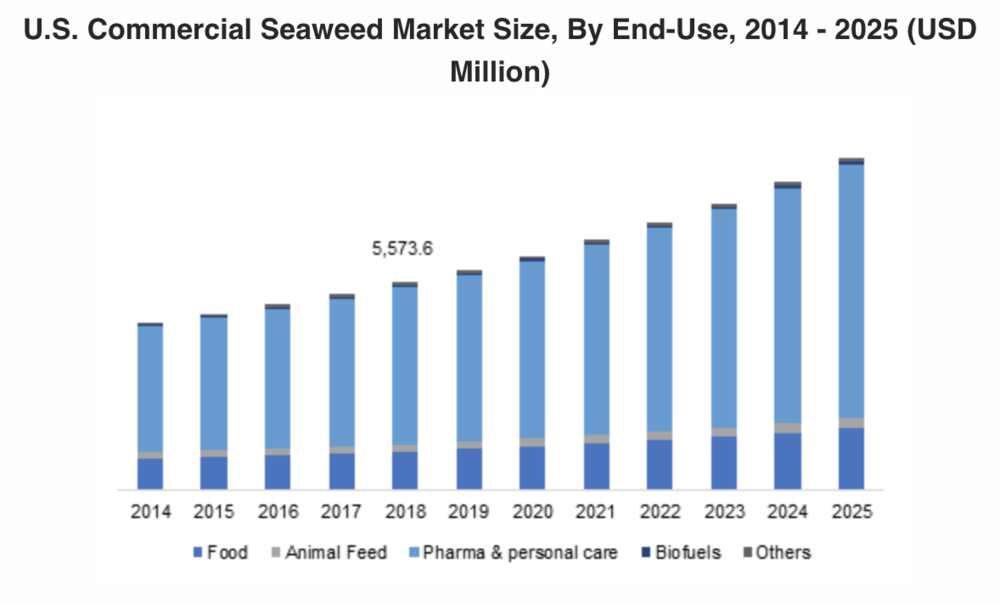

Fast forward to today and growth projections for farmed seaweed are strong. One recent study estimates the industry will grow to $92 billion by 2025 across a diverse range of markets. If you want to take a deeper dive, take a look at the Island Institute’s Edible Seaweed Market Analysis and the United Nations’ Global Status of Seaweed Production, Trade, and Utilization.

Source:

Source: Global Market Insights

Viable Near-term Markets

To separate wheat from chaff, GreenWave has identified four industries that we see as viable, shovel-ready sales channels for farmers: food, bioplastics, agricultural products, and blue carbon and nitrogen. We see these as the primary drivers of near-term market growth.

GreenWave’s Role

GreenWave works to open up new sales channels for small and medium-scale regenerative ocean farmers by leveraging our robust network of buyers. We’ve connected farmers with national processing companies, entrepreneurs making value-added products, corporate cafeterias, producers of bio-plastics, and retail outlets.

We also partner with value-added processors, wholesalers, and retailers to identify and overcome market barriers to ensure demand grows as GreenWave farmers scale.

Whole Leaf Strategy: Diversifying Markets

Think of this as a "whole leaf" strategy. Before crops are planted, every part of the plant is pre-destined for its appropriate market. For example, the youngest part of the leaf is turned into kelp noodles and the oldest is turned into compost and bioplastic straws.

Food

→ Value-added

→ Ingredients

Bio-Plastics

→ Straws

→ Packaging

Agriculture

→ Fertilizer

→ Compost

Long-term Markets

One of the powers of seaweed is that it has so many uses. It’s the soy of the sea without all the downsides. But the wide range of potential markets makes the space confusing for farmers and entrepreneurs. Based on our work in the market innovation space, we see some sectors as too uncertain to be economically viable at this stage.

Farming kelp for biofuel, for example, is decades off. And while industries such as cosmetics and pharmaceuticals use seaweeds in a range of products, they often rely on varieties that are not native to U.S. waters or grown in land-based tank systems, neither of which make sense for GreenWave’s farming network.

Want to learn more?

Learn more about Our Programs.

Check out Seaweed Source.

View Our Farm & Hatchery.